Panther’s Shielded Pools: The cornerstone of the protocol

Table of Contents:

In an increasingly complex DeFi environment, preserving privacy while enabling regulatory compliance has become both a challenge and a necessity.

This article will delve deeper into the linchpin of Panther Protocol’s architecture –Multi-Asset Shielded Pools (MASPs). Shielded Pools, as we call them in Panther, are sets of smart contracts where users can deposit various tokens, safeguarded by cutting-edge cryptographic techniques such as zk-SNARKs and zero-knowledge proofs (ZKPs). This renders the transactions within these pools untraceable while providing users with the flexibility to selectively disclose information, thus enabling a pathway to compliance.

Throughout this article, we will explore the intricate mechanics and far-reaching implications of MASPs within Panther’s ecosystem. We will also talk about Panther’s significance for the DeFi landscape and delve into the unique incentives system created by our design.

Diverse Pool Privacy (or “Why multiple assets?”)

By allowing users of multiple kinds of assets to enter the Pool (e.g., different tokens types supported within a given chain, such as ERC-20, non-fungible, and other standards of tokens), users of every compatible token can access the same privacy, regardless of the liquidity of their assets. While a single-asset Pool for rarely-used tokens would struggle to find much security due to the relatively low volume of transactions, MASPs can leverage popular assets to quickly build critical speed and provide much-needed privacy to the long tail of crypto assets.

The fact that different types of assets can co-exist in the same Pool is called Diverse Pool Privacy. Thanks to it, Pools can get large enough to preserve data heterogeneity, i.e., have so many transactions happening within them that it becomes impossible to track and deanonymize users.

How do Shielded Pools work?

In their technical build, Shielded Pools are essentially a collection of append-only Merkle trees, where each leaf is a commitment to a UTXO representing a number of zAssets (or zNFTs) –essentially an IOU for the corresponding collateral deposited by a user and locked in the Panther Vault.

At v1, Panther’s Pools will support the following activities:

Registering and activating zAccounts and zero-knowledge compliance checks

Within Panther, zAccounts are akin to bank accounts. All transactions done by a given user are linked to the same zAccount. Panther developed this novel mechanism to support compliance, decentralized identity, and selective disclosures. Using zero-knowledge technology, Panther safeguards users’ on-chain data privacy and ownership.

zAccounts are implemented using a particular type of UTXO inside the UTXOs Merkle Tree. Every zAccount UTXO contains important values at a user/account level, such as the zAccount’s ID, ZKP balance, PRP balance, ZoneID, etc.

Depositing, transferring, and withdrawing assets in Shielded Pools

The core functionality of the MASP is to allow users to safely deposit assets and transfer them to others within the system. Additionally, it lets users prove their balance in a private setup or withdraw their assets to a publicly owned wallet.

The MASP assigns every UTXO an exact “owner” or recipient, the only person able to spend it. This is achieved by including a public (spending) key in generating the UTXO commitment, for which only the recipient knows the corresponding private (spending) key.

However, rather than using a single fully public spending key for each recipient, known to the whole world, a new spending keypair is derived. This pair is guaranteed to be unique for each UTXO and strengthens the system’s privacy while offering greater flexibility to disclosure schemes.

To begin with, Panther’s Shielded Pools will support only 10 assets, with the Panther DAO deciding when and how to expand this list.

Managing a Zone and its criteria

Shielded Pools are infinitely divisible into Zones. Zones are logical partitions of liquidity used to create Access Control Lists within the Pool. There is no finite number of Zones a Pool can contain, and, being within the same Pool, they all share the same zero-knowledge protection.

Every Zone is identified by a Zone-ID, and every Zone-ID is attached to a Zone Manager. A Zone Manager configures the parameters of the Zone, its allowed users, and gatekeeping/compliance-related requirements. Zone-IDs’ associated functionalities to manage Zones and their parameters make them a powerful tool that provides enhanced risk management features for regulated entities to function in the DeFi space.

For example, there can be two separate Zones that whitelist the wETH token:

- Zone A, run by InstitutionX, with very strict compliance requirements.

- Zone B, run by the Panther DAO.

Since InstitutionX’s requirements are very strict, every UTXO belonging to it will have its Zone-ID, plus some metadata. This UTXO can be transferred only within the same Zone-ID if InstitutionX decides it. In this case, no one from outside this ID would be able to do deposits or withdraw to/from it. Similarly, users of this Zone-ID could only exchange UTXOs inside it.

Panther is also implementing zAccount-blacklisting for wallets associated with illicit wallet activity and other sanctioned users. Zone Managers can manage and control this depending on their preferences and what rules govern the operation of each specific Zone. For this, Panther uses a zAccountBlackListRecord MerkleTree, which is incremental and updateable but without saved root history. This tree can backlist a zAccount-ID from using the whole Panther protocol.

Rewarding users

Panther’s incentive mechanics allow the protocol to issue rewards to users in the form of units called PRPs (Panther Reward Points) within the Pool. Users receive rewards whenever they conduct an activity beneficial to the protocol’s privacy set, such as depositing assets, triggering internal transactions, using DeFi Adaptors, etc.

Rewards being distributed in PRPs allow for a distribution model between PRP holders and total rewards in the Reward Pool at any given time. PRPs are stored as a balance in each zAccount’s UTXO and are updated upon Spend transactions.

Exchanging PRPs to $zZKP

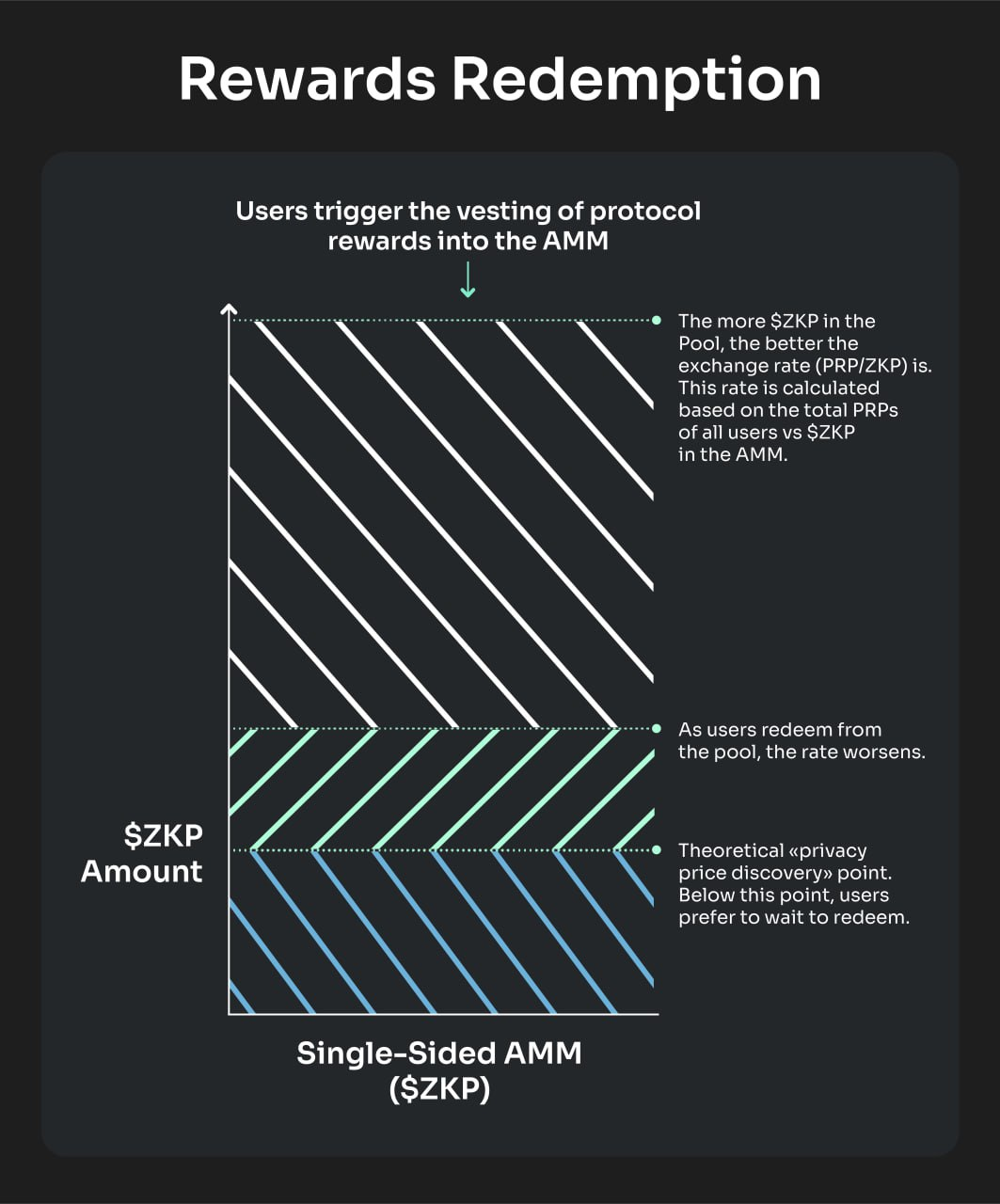

Panther’s single-sided Automated Market Maker (AMM) allows users to redeem their PRPs for $ZKP within the Pool ($zZKP). Users top up the $ZKP pool within the AMM while earning additional rewards to facilitate this exchange.

Panther’s AMM functions by allowing users to redeem at a fluctuating rate. Exchange rates in this system are proportional to $ZKP in the pool and the total PRPs available. Through this mechanism, Panther creates a game-theoretical way to price privacy. The protocol will initially only charge fees (denominated in $zZKP) from users aiming to withdraw their assets. These fees eventually circle back to being distributed as rewards.

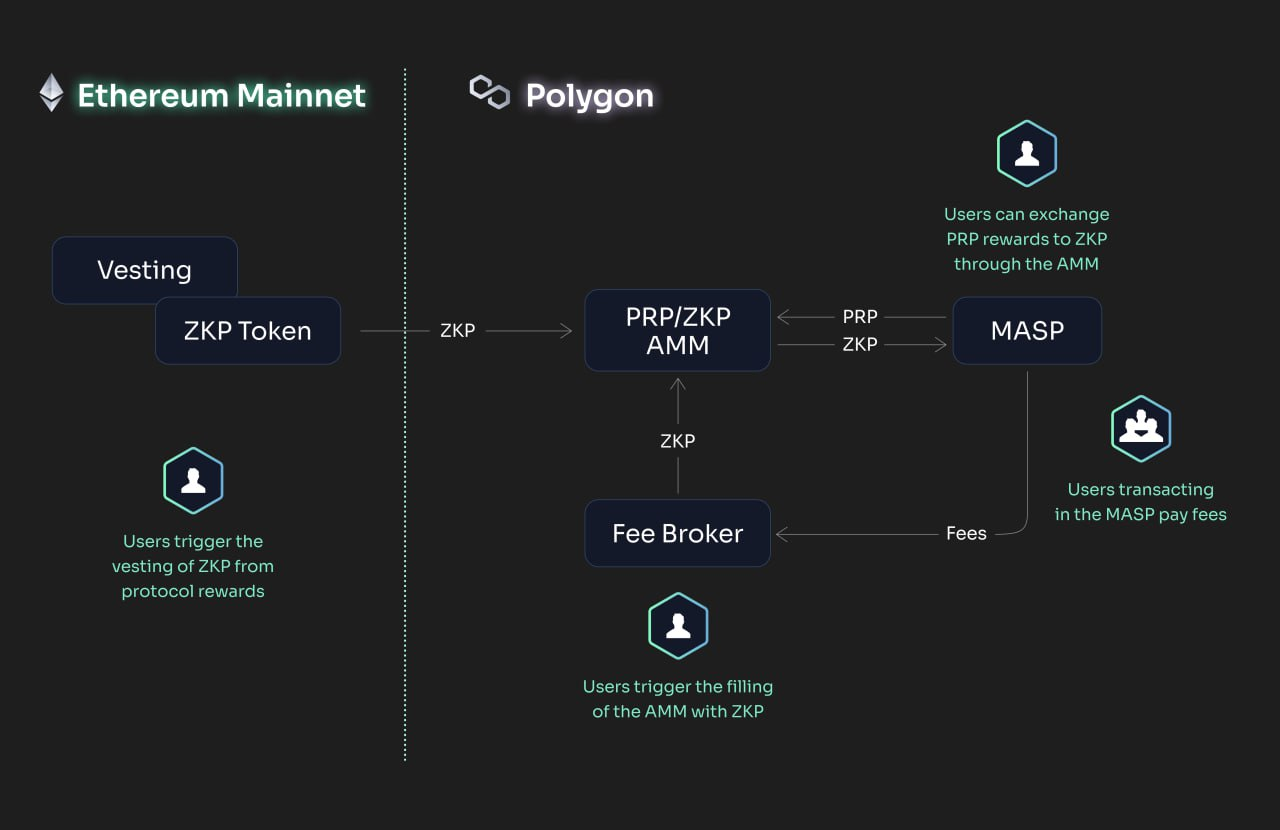

The diagram below explains the workings of the rewards mechanism, from the vesting of reward tokens to users exchanging their PRPs for $ZKP.

Furthermore, the single-sided AMM itself is represented in the diagram below:

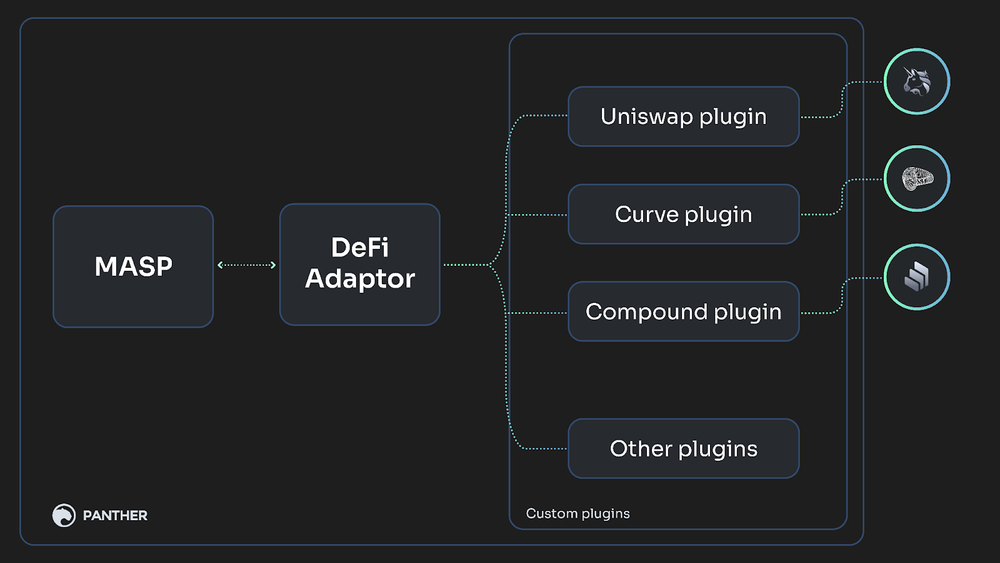

Interacting with DeFi dApps and protocols

Shielded Pools are connected to DeFi through custom plugins called “DeFi Adaptors.” The first use case for Panther’s DeFi Adaptors, zSwap, allows users to execute swaps on the most liquid DEXs without publicly revealing their identity.

The ability for users to send assets to DeFi protocols serves a double purpose: allowing users to access DeFi while decreasing the likelihood of an external observer tracking users’ assets and activity. In other words, users can swap assets, interact with DeFi, and trade with one another, but no one can link assets within the pool to specific users. This applies even when deposits/withdrawals to/from the Pool itself are viewable by observers.

As an example, thanks to Adaptors, even if Alice deposited 1000 USDC into the Pool, no one can be fully sure whether a given 1000 USDC withdrawal is Alice’s, as she could have easily swapped them for ETH, LINK, MATIC, or another asset on an external DEX. To learn more about DeFi Adaptors, go to our dedicated blog post.

zTrade: Orderbook trades at fixed rates

Within Panther, OTC trades are enabled by a component known as the “MASP plugin.” This is an extension to the MASP’s smart contracts that aims to enhance its base system with extra functionalities.

In the case of zTrade, the additional functionalities provided are atomic swaps. An atomic swap is an asset swap between two parties in a single transaction. zTrade is a MASP Internal atomic swap —a transaction that swaps UTXOs inside a Pool.

Note: While sometimes “atomic swaps” is used to refer to cross-chain transfers, the internal mechanism used for zTrade is identical; it just happens within the MASP.

This has significant advantages over centralized or decentralized swap mechanisms, such as:

- Zero slippage on large trades.

- Low fees.

- Instant settlements with data protection.

- Possibly, earning rewards (to be defined by the community).

Shielded Pools’ cross-chain functionalities

To realize the protocol’s vision of cross-chain zero-knowledge access to DeFi, Panther will deploy its Shielded Pools onto multiple blockchains (L1s and L2s). zBridges will connect these Pools on different blockchain networks, enabling cross-chain transactions and compounding the difficulty of tracking user activity.

In the future, we’ll publish more information on zBridges through our blog and documentation.

In conclusion

Beyond mere privacy preservation, Panther is transforming the DeFi landscape by offering unique incentives and aligning different needs towards an improved user experience.

As you have learned, a key milestone for Panther is to deploy Shielded Pools onto multiple blockchains, further strengthening the ecosystem and diversifying access to DeFi. This vision, which puts users in control of who views their data while retaining compliance, constitutes a first-of-its-kind approach that leverages existing liquidity, increases connectivity, and can attract institutions and retail users alike.

Shielded Pools are one of the core components of this vision, but there are many more. In future articles, we’ll expand over zBridges, Zones, zTrade, and much more!

About Panther

Panther is a cross-protocol layer that uses zero-knowledge technology to build DeFi solutions that meet regulatory requirements and satisfy users' on-chain data privacy needs. The goal of Panther is to allow seamless access to DeFi and create a cross-chain-supported architecture that serves different use cases. Panther’s zero-knowledge primitives are also generalizable to KYC, selective disclosures between trusted parties, private ID, voting, and data verification services.

Website · Documentation· Lite Paper · Twitter · Telegram · Discord