Privacy crypto projects: real Bitcoin competitors or not?

Table of Contents:

There are no clear Bitcoin competitors when it comes to value-oriented blockchains.

Bitcoin has over 180 million users, and the network averages hundreds of thousands of daily transactions, facilitating cross-border payments. However, as more people regard Bitcoin as a full-fledged digital asset akin to gold or real estate, the question of who can compete with the orange giant on other terms comes to mind.

One particular reason behind Bitcoin's global adoption is the pseudonymity that its users enjoy. Beyond being a value store and viewed as a viable long-term investment, Bitcoin allowed people to move money without needing banks and traditional financial infrastructure. Although people could transact under pseudonymous identities—the creator(s) of Bitcoin went by the alias Satoshi Nakamoto—this increasingly represents a challenge.

In this write-up, we will explore the concepts of transparency furthered by Bitcoin and most blockchains, and their numerous drawbacks. Additionally, we will analyze the nature of privacy-centric blockchain solutions, whether they’re truly competitors per se, their potential users, and (briefly) how Panther Protocol plays a part in this discussion.

Why is Bitcoin transparent?

Bitcoin aimed to achieve a complete decentralized financial system, one without a centralized body of trust in the middle. Without go-betweens like banks that hold control over users' funds, Bitcoin proposed a replacing system that could drive trust on the network, making every single payment network in the world a Bitcoin competitor.

To do this, Bitcoin puts an emphasis on full transparency and verifiability. Satoshi Nakamoto, shared his vision of the project on October 31, 2008, releasing the Bitcoin whitepaper. This whitepaper outlined a peer-to-peer electronic cash system.

Bitcoin is an open and permissionless blockchain, which makes all the information on the blockchain accessible to anyone. With complete transparency, Bitcoin ensured that network participants (miners, nodes, users) couldn’t collude to manipulate the state of the network. This total transparency also meant that anyone could verify the holdings of each address and the size of all transactions at any given time.

What are the benefits of transparency in blockchain?

Although the network supports pseudonymity, Bitcoin's transparency has arguably bolstered trust in decentralized blockchain networks. This led to the massive adoption and exponential increase in the number of individuals investing in cryptocurrencies globally. A financial system where anyone can access every record stored on the blockchain is attractive to the everyday person, especially as trust in traditional finance models continues to erode.

The transparency of the Bitcoin network has also helped discourage certain criminal elements from using the blockchain. While regulators were slow to get the cryptocurrency drift, they eventually caught up and have begun to enforce regulations guiding cryptocurrency trading. Due to public blockchains’ transparency, it is easy for law enforcement agencies to track movements of illicit money and maybe tie the wallet addresses to identities.

Transparency, along with permissionlessness has created many blockchain enthusiasts across several sectors. Many have advocated blockchain use in online voting, an exercise that demands utmost transparency. Supply chain operations have also adopted blockchain technology to achieve transparent farm-to-shelf or manufacturing-to-consumer product lifecycle tracking. Digital ownership via non-fungible tokens, decentralized identity, file storage, and other concepts have since adopted the blockchain due to its transparency.

The emergence of privacy-centric “Bitcoin competitors”

Although Bitcoin's transparency can be considered a strength, concerns over user privacy have led to the creation of several privacy-conserving solutions that aim to provide total anonymity to their users. Coin tumblers or mixers were the earliest of these methods but, as adoption grew, network congestion led to higher transaction fees, which made them too expensive to manage.

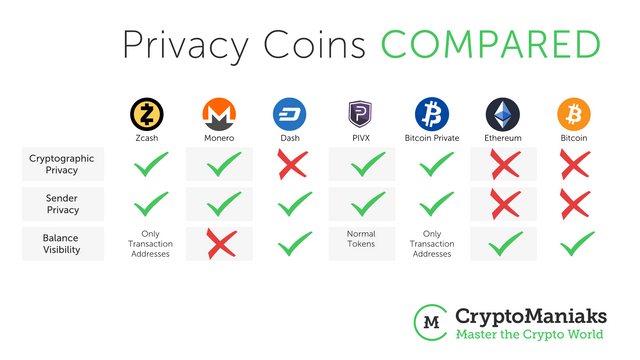

Then came privacy coins. These private cryptocurrencies used different cryptographic tools to shield transaction information and user identity. A famous example and one of the most successful private coins is Monero ($XMR). Monero adopted ring signatures, stealth addresses, and ring confidential transactions (RingCT) to provide complete anonymity to its users, while also being a fully functional smart contracts platform. Monero's success is well-known and has given rise to a bounty by the United States government to anyone who can crack the network’s cryptography.

Zcash came into the fray almost simultaneously, using zero-knowledge proofs and shielded transactions to provide anonymity. Zero Knowledge Succinct Non-interactive Arguments of Knowledge (zk-SNARKs) allowed users to present transaction receipts without revealing any information about the nature of the transaction and its participants. However, Zcash was not private by default like Monero, allowing users to transact without privacy at their behest.

Other privacy coins like Grin, Horizen, ARRR (Pirate Chain), and Verge have also successfully maintained blockchain privacy. However, regulators continue to subject them to scrutiny. Bitcoin’s little brother, Bitcoin Cash, is just as traceable, since they’re built on the same blockchain architecture. Notably, projects like Monero and Pirate chain act in an open-source fashion with pseudonymous teams.

What are the downsides of transparency in blockchains?

As explained earlier, users have continued to raise concerns about Bitcoin's radical transparency. The primary grouse is the lack of user privacy which, albeit is already a problem for the network, can continue to increase exponentially as the network grows.

The threat of hackers

One primary problem of the lack of privacy is the exposure of individuals' financial information to bad actors. Hackers and fraudsters can easily monitor their targets' on-chain transactions and construct fraudulent schemes around the available information.

A criminal can easily access thousands of public addresses, which they can screen for potential victims. While you can view transaction records on a private blockchain solution, you cannot find any additional information on any transaction or the amounts and addresses involved. Some privacy coins like Monero do not disclose wallet balances through public addresses.

Government suppression

Another challenge that blockchain transparency has led to is the common habit of government suppression through tracking and freezing digital currencies. For example, in February 2022, Canadian truckers began to protest the government's decision to make COVID-19 vaccinations compulsory for them. They even started a fundraiser towards pursuing legal action. After unsuccessful attempts to quash their peaceful protests and intentions to challenge the decision in court, the Canadian government began a crackdown on the fundraising efforts and all that contributed to it.

In this case, not only did the government freeze regular bank accounts, but they also went after one of the largest cryptocurrency exchanges, Kraken, forcing them to comply with the directives to freeze digital currencies. Privacy, of course, is impossible on centralized crypto exchanges, as they must comply with strict KYC/AML regulations.

The government also extended a similar request to Nunchuk's self-custodial wallet provider. However, their attempt was unsuccessful as self-custodial wallets encourage privacy and do not store information on users' assets or identities.

Governments tracking the finances of their citizens or political enemies is not unheard of, and cryptocurrency transparency only makes this more accessible. When a public address is linked to your identity, the government can easily find out whatever they need to know about your financial dealings whenever they want.

Your privacy is important

Apart from the threat of hackers and government suppression, keeping your finances private is an individual right and just makes sense to most users. After all, it’s fairly rare for people to openly discuss their financial detail, let alone with strangers.

Sadly, blockchain transparency, while it serves to drive trust and accountability on the network, also exposes everything about a user's holdings, the value of their assets, and all deposits and withdrawals. Traditional bank accounts are, in fact, more private than public blockchains, as they are only privy to their owners and law enforcement agencies (on special occasions), giving the account owner some measure of privacy.

A major downside regarding privacy is the possibility of users’ identities being tied to their wallets. Once a user’s identity is tied to their wallet, it’s possible for them to be exposed to consequences (even life-threatening ones) since the value of the assets is open for anyone to see.

While individuals should prioritize their privacy, financial institutions dealing in crypto can hardly stay ahead of the competition if all the details of their trades or deals are out in the open. Transparency in blockchain robs them of any competitive advantage they may have.

Therefore, the quest for "bitcoin competitors" starts when people are yearning for privacy and freedom.

Who should consider privacy-maintaining blockchains

Private cryptocurrency solutions are becoming increasingly popular, and different categories of individuals have embraced them recently. Privacy and data security activists are one group that readily embraces the use of private cryptocurrencies. This is also helpful as it drives across a statement supporting private blockchain solutions focused on restoring users' control over their digital information.

Whistleblowers and political activists should also adopt privacy blockchain solutions, seeing that governments will never cease to scrutinize their affairs. Political activism, after all, requires financial support, especially under oppressive governments. Privacy blockchain solutions provide a clear path for ordinary people to support political activists without endangering their finances.

The case of the Canadian truckers taught a bitter lesson to communities and associations that are politically suppressed. Traditional finance, and even Bitcoin, are too open and can be turned into weapons. While Bitcoin encourages pseudonymity, most points in which it can be exchanged for official currencies require users to provide verifiable identity documents to use their services.

So-called fiat on-ramps need to comply with existing regulations such as KYC/AML that force them to freeze assets belonging to offenders. Privacy solutions, on the other hand, can help politically oppressed communities raise funds and escape any form of financial backlash due to the anonymity these protocols provide.

Financial institutions in Web3 can also retain their competitive advantage and transact without being subject to scrutiny from competitors and regular individuals using privacy solutions.

Luckily for all the above, there are several different ways to achieve privacy and still benefit from the permissionlessness of blockchain technology.

Bitcoin Competitors: Methods to achieve on-chain privacy

Since we established the downsides of blockchain transparency and the need for privacy, let’s have a look at Bitcoin alternatives that don’t compromise user privacy.

There are majorly four different mechanisms that achieve on-chain privacy. However, it’s worth noting here that although these mechanisms offer on-chain privacy that Bitcoin lacks, they come with their own set of limitations.

For example, privacy coins often have trouble with on-off ramps, miss out on some centralized crypto exchange listings, access to the DeFi ecosystem, and so on. Similarly, other alternatives like coin mixers support only one asset type at a time and only in a determinate amount (e.g. only in batches of 1 BTC at a time per mixer), thus severely limiting their privacy prospect.

Method #1: Create private ways to transact (private chains)

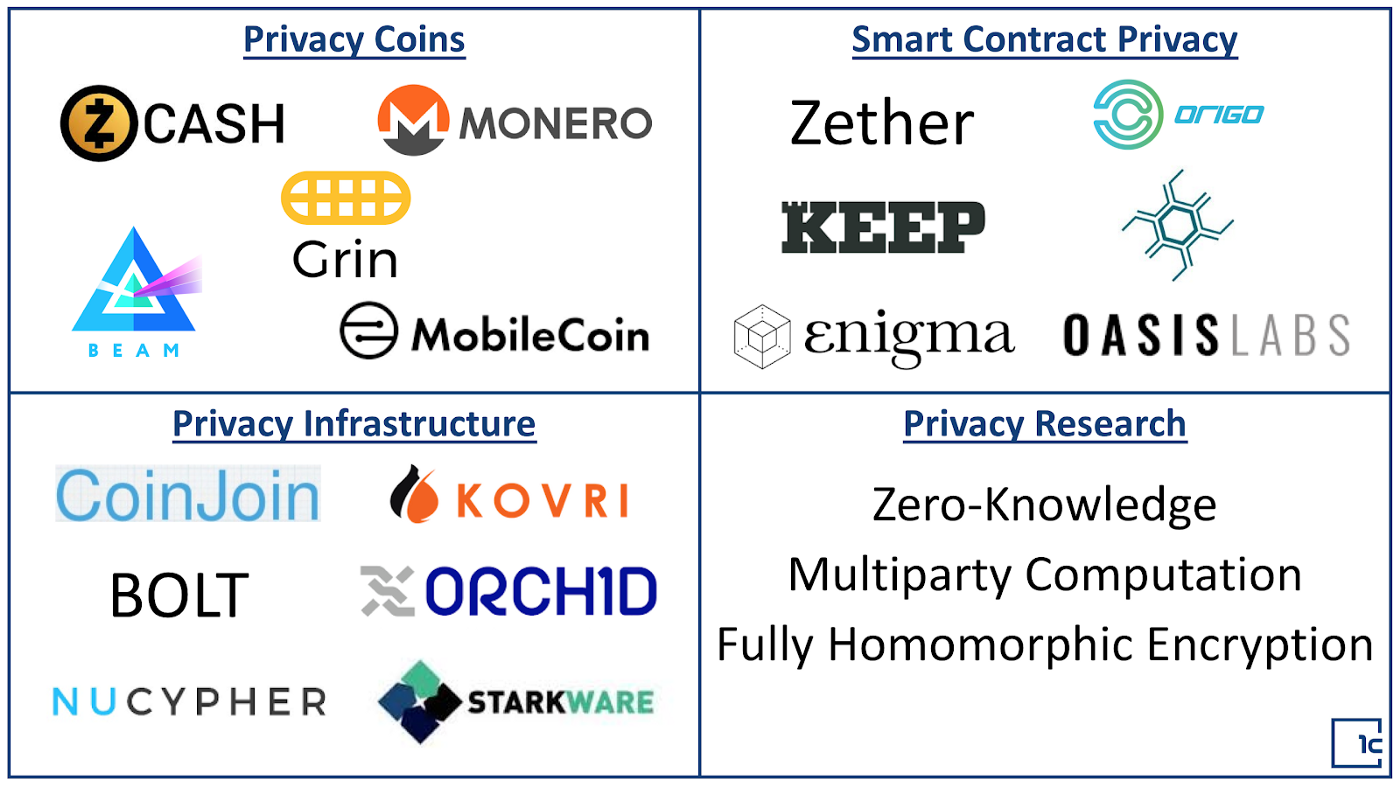

The most popular method through which on-chain privacy can be achieved is by creating private chains, hosting privacy coins. Unlike public blockchain networks such as Bitcoin or Ethereum, privacy coins can offer greater transaction obscurity.

Privacy coins preserve users’ privacy by concealing sensitive information involved in transactions from the public eye. They thereby enable users to make transactions without revealing wallet addresses, transaction amounts, senders’ and receivers’ wallet addresses, etc. Some popular examples of privacy coins are Zcash and Monero.

Method #2: Private blockchain networks with private ecosystems

Private blockchain transaction networks do offer on-chain privacy but miss out in terms of offering DeFi innovation, running smart contracts, or an ecosystem. Public blockchain networks, on the other hand, are massively ahead in terms of offering a range of decentralized financial services such as lending, borrowing, stablecoins, etc. because of smart contracts.

This limits the use of privacy coins to simple transactions, making them less attractive in comparison. Solutions such as Secret Network, Oasis Labs, Zether, and others attempt to solve this by creating ecosystems that enable default privacy.

Offering private DeFi services is a massive leap forward in innovation when it comes to leveraging blockchain technology. DeFi services are a serious contender to Bitcoin since Bitcoin misses out on smart contract capabilities, thus lacking a DeFi ecosystem. However, Bitcoin’s inability to plug into DeFi does cause the current DeFi ecosystem to lose access to a major source of liquidity. Although this is partially solved through wrapped Bitcoin (wBTC), it’s still far from reaping the full benefits of Bitcoin.

Something can be said, however, about the way private smart contract blockchains create siloed ecosystems. The most popular blockchains, albeit public, have created thriving environments which these solutions try to take users away from, creating a zero-sum game in the opinion of some.

Method #3: Utilizing mixers

Yet another way of achieving on-chain privacy on public blockchain networks such as Bitcoin is to use coin mixers. Coin mixers or tumblers allow you to make untraceable transactions while keeping your dealings away from the public eye, preserving your identity and obscuring sensitive information on the transactions you have made.

However, just like the other competitors already mentioned, they also have their disadvantages. Coin mixers have their own set of limitations and pose some unique challenges. For example, most crypto mixing services also operate in legal obscurity and might get you in trouble if your jurisdiction introduces a law against them and applies it retrospectively. Additionally, some of the models used by coin mixers can be bypassed with the help of blockchain forensics and analytics firms.

Method #4: Find a way to infuse existing systems with privacy

The most innovative and user-friendly way to achieve privacy without reinventing the wheel could be to infuse existing systems with privacy. This is where Panther comes into the picture, providing an on-chain privacy solution that fits right along with existing decentralized applications.

Panther Protocol: Interoperable privacy for DeFi

Panther Protocol seeks to restore privacy and trust across different blockchain networks. The solution creates a level playing field for individuals and institutions alike, helping them foray into decentralized finance while eliminating privacy concerns.

Panther utilizes zero-knowledge proofs with zkSNARK technology, which allows users to present genuine transaction proofs while keeping sensitive details confidential. Panther also adopts a multi-asset shielding feature that breaks the on-chain trail as users deposit their assets into a pool and mint 1:1 collateralized zAssets, which allows them to transact privately.

Unlike most privacy solutions, Panther Protocol is not limited to a particular blockchain network. Panther uniquely offers cross-chain solutions with a privacy toggle, allowing users to deposit their favorite cryptocurrencies, mint the corresponding zAssets, and transact across different blockchains.

Regarding compliance, Panther Protocol balances the equation with zero-knowledge reports that allow users to share data with trusted third-party providers, thus preserving their privacy and remaining compliant with existing regulations.

Conclusion: Privacy might not be enough for a project to call itself a Bitcoin competitor

It’s impossible to draw a clear winner when it comes to whether privacy coins are truly Bitcoin competitors. On one hand, Bitcoin is the foundation of the crypto economy and the most valuable asset, keeping its crown as a crypto market leader, with a market cap of over $1 trillion at the time of writing. Competing digital currencies, private or not, on the other hand, aim to offer additional features and some advantages over Bitcoin, but are unlikely to ever take its current place.

In essence, there are no confirmed winners and losers since the crypto economy is still in a nascent stage. The market will dictate which cryptocurrency is the most useful, and it currently hasn’t decanted for privacy, although privacy proponents argue that their features are more than needed by Bitcoin. However, we may not discard the fact that Bitcoin believers might not consider these features necessary in the first place.

It seems like we will have to wait and see whether the crypto market starts putting a higher emphasis on Layer-1 transaction privacy to make a final decision.

About Panther

Panther is a decentralized protocol that enables interoperable privacy in DeFi using zero-knowledge proofs.

Users can mint fully-collateralized, composable tokens called zAssets, which can be used to execute private, trusted DeFi transactions across multiple blockchains.

Panther helps investors protect their personal financial data and trading strategies, and provides financial institutions with a clear path to compliantly participate in DeFi.

Stay connected: Telegram | Twitter | LinkedIn | Website